How to open Branches Office

Branches of Foreign Companies

Foreign companies may carry out certain business in Thailand through a branch office. Branch offices are required to maintain accounts only relating to the branch in Thailand.

Having a branch office in Thailand, the foreign corporation could be exposed to civil, criminal and tax liability if the branch office violates any law in Thailand. The foreign head office must appoint at least one branch office manager to be in charge of operations in Thailand.

There is no special requirement for foreign companies to register their branches in order to do business in Thailand. However, most business activities fall within the scope of one or more laws or regulations that require special registration (e.g., VAT registration, taxpayer identification card, Commercial Registration Certificate, Foreign Business License, etc.), either before or after the commencement of activities. Therefore, foreign business establishment must follow generally accepted procedures.

It should be borne in mind that the branch is part of the parent company and therefore the parent retains legal liability for contracts, and for tortious acts done. For tax purposes, a branch is subject to Thai corporate income tax at the regular 20% rate on income derived from its business operations in Thailand. It is important to clarify beforehand what constitutes income that is subject to Thai tax because the Revenue Department may consider revenue directly earned by the foreign head office from sources within Thailand to be subject to Thai tax. Therefore, for tax purposes, a branch office is required to apply for a taxpayer identification card and VAT certificate (if applicable) and to file annual corporate income tax returns with the Revenue Department.

A branch office of a foreign entity cannot carry out any reserved business without a Foreign Business License. It must apply for a Foreign Business License with the MOC first, and can operate as a reserved business only after the license has been issued. If the desired business is unique, and does not compete with Thai businesses, or involves dealings among members of an affiliated company, the chance of approval is more probable. Conditions, such as minimum capital, transfer of technology and reporting requirements, may be attached to the Foreign Business License. The minimum investment capital must be greater than 25% of the estimated average annual operating expenses of the operation calculated over 3 years, but not less than 3 million Baht.

Conditions to be complied with by the Branch Office after Obtaining Permission for Operation

A Branch Office that is permitted to operate the business must comply with the following conditions:

1. There must be the minimum capital to be remitted to Thailand for the commencement of business operation as stipulated by law. Details of remitting the minimum capital are as follows:

1) First 25% of minimum investment within first 3 months;

2) Another 25% of minimum investment within first year;

3) Another 25% of minimum investment within second year; and

4) Last 25% of minimum investment within third year. 13

2. The total amount of loans utilized in the permitted business operation must not exceed 7 times the inward remitted funds for the permitted business operation;

- Loans mean the total liabilities of the business, notwithstanding the liabilities incurred by any form of transaction but excluding trade liabilities occurred from the ordinary course of business, such as, trade creditors, accrued expenses.

3.At least one person out of the people responsible for operating the business in Thailand must have a domicile in Thailand;

- Domicile means the contactable residence in Thailand which can be the place of business, excluding temporary residence such as hotels.

4. The document or evidence relating to the permitted business operation must be submitted when the official sends the summons or inquiry.

5. Their account and financial statements to be submitted to the Department of Business Development must be prepared.

Fees for Branch Office

Application fee (non-refundable) is 2,000 Baht. If the application is approved, the Government fee will be set at the rate of 5 Baht for every 1,000 Baht or fraction thereof of the registered capital of the parent company, with a minimum of 20,000 Baht and a maximum of 250,000 Baht. A fraction of 1,000 Baht in capital is regarded as 1,000 Baht.

For opening branch office, please directly contact Department of Business Development (DBD) at www.dbd.go.th (https://www.dbd.go.th/dbdweb_en/) or +66 2547 4425 / +66 2547 4426 or call center 1570.

Regarding your inquiries, we can explain in 2 cases which cover your questions;

Case 1: Installation of a smart grid system or implementation of renewable energy that is used in your own business.

The applicant can apply for BOI promotion under the measure to promote energy conservation, alternative energy utilization or reduction of environmental impact to use renewable energy. Please find detail from the announcement no.9/2560.

Conditions

(1) The applicant must submit an investment plan for machinery replacement or upgrade to save energy, to introduce alternative energy into the project, or to reduce environment impacts by implementing one of the following:

(1.1) Project must invest in upgrading machinery to modern technology that reduces energy consumption at the stipulated ratio.

or

(1.2) Project must invest in upgrading machinery to use alternative energy at the stipulated ratio to the total energy consumption.

or

(1.3) Project must invest in upgrading machinery to reduce environmental impacts; namely, reducing waste, waste water or exhaust air according to the stipulated criteria.

(2) The minimum capital investment mush not be less than 1 million baht (excluding cost of land and working capital).

(3) The application must be submitted by December 30, 2020, and the project mush complete implementation with three year from the date the certificate is issued.

Incentives

(1) Exemption of import duty for machinery.(2) 3-year corporate income tax exemption on the revenue of an existing project, accounting for 50 percent of the investment under this measure (excluding cost of land and working capital).

(3) Corporate income tax exemption period shall start from the date of revenue derivation after promotion certificate is issued.

Case 2: Installation of a smart grid system or implementation of renewable energy for sale to other companies, you can request BOI promoted in the activity 7.1 Public utility and basic services.7.1.1 Production of electricity or electricity and stream

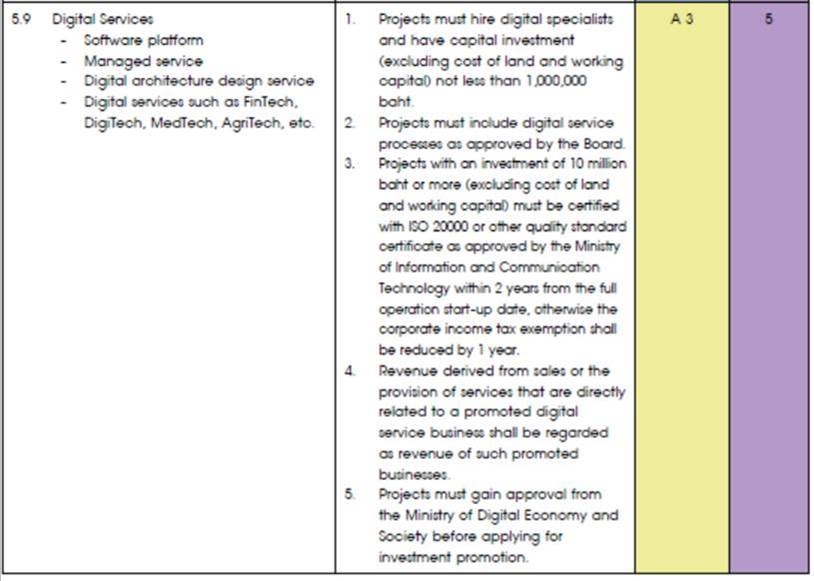

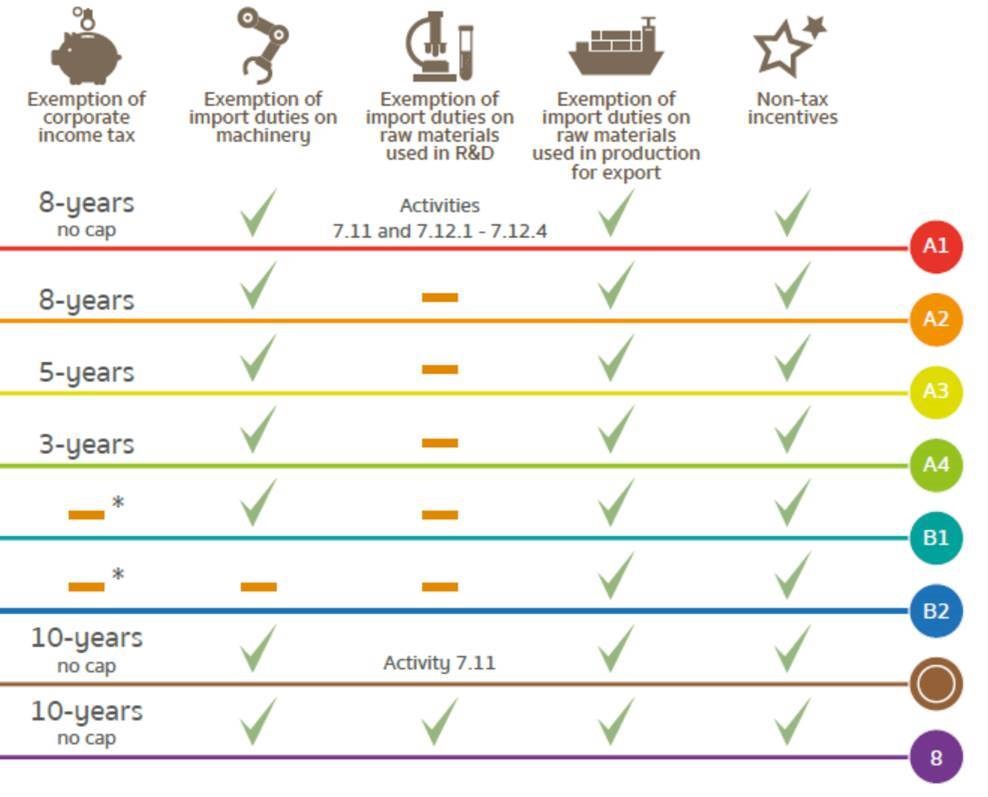

7.1.1 Production of electricity or electricity and stream from garbage or refuse derive fuel. The project can get the incentives in category A1.

7.1.2 Production of electricity or electricity and stream from renewable energy such as solar energy, wind energy, biomass or biogas, etc. except from garbage or refuse derive fuel. The project can get the incentives in category A2.

7.1.3 Production of electricity or electricity and stream from other energy sources. In case of cogeneration of if the project use coal, it must only use clean coal technology, the project can get the incentives in category A4.

Tax Incentives:

(1) Exemption of corporate income tax:

(2) Exemption of import duty for machinery.- Category A1 : 8-year corporate income tax exemption (unlimited net profit excluding the cost of land and working capital).

- Category A2 : 8-year corporate income tax exemption (limited net profit excluding the cost of land and working capital).

- Category A4 : 3-year corporate income tax exemption (limited net profit excluding the cost of land and working capital).

(3) Exemption of import duties on material imported for R&D purposes.

Non-Tax incentives

(1) Permit for foreign nationals to enter the Kingdom for the purpose of studying investment opportunities.(2) Permit to bring into the Kingdom skilled workers and experts to work in investment promoted activities.

(3) Permit to own land.

Regarding your concern about starting business with 100% foreign ownership in Thailand, there are possible requirement as follow :

In case that you would like to conduct such business (business which is classified in list 3 under List Annexed to Foreign Business Act (Foreign Business Act.pdf)) with exceeding 49% foreigner to own the shares, you are required to get a permission from Foreign Business Administration Division (FBA).

For the procedures to apply for Foreign Business License (FBL), please find in the attached file: SECTION 17 Procedure.pdf.

The location to apply for FBL shall be the HQ of the DBD at Nonthaburi only.(http://www.dbd.go.th/dbdweb_en/more_news.php?cid=246)

- Please be informed that you can do such business without necessary to get FBL if you can maintain Thai shareholding ratio of the company to be larger than 50%.

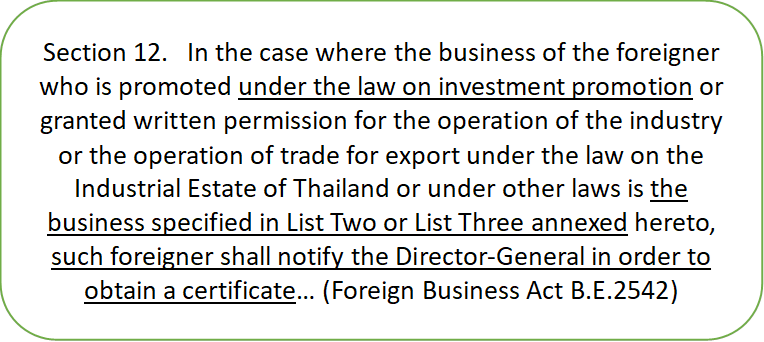

Please note that in the case where the business of a foreigner that is promoted under BOI investment promotion, the foreigner can apply for foreign business certificate (FBC). The foreigner shall notify the Director-General in order to obtain a Certificate. So, in case of BOI promotion project, no need to apply for Foreign Business License (FBL).

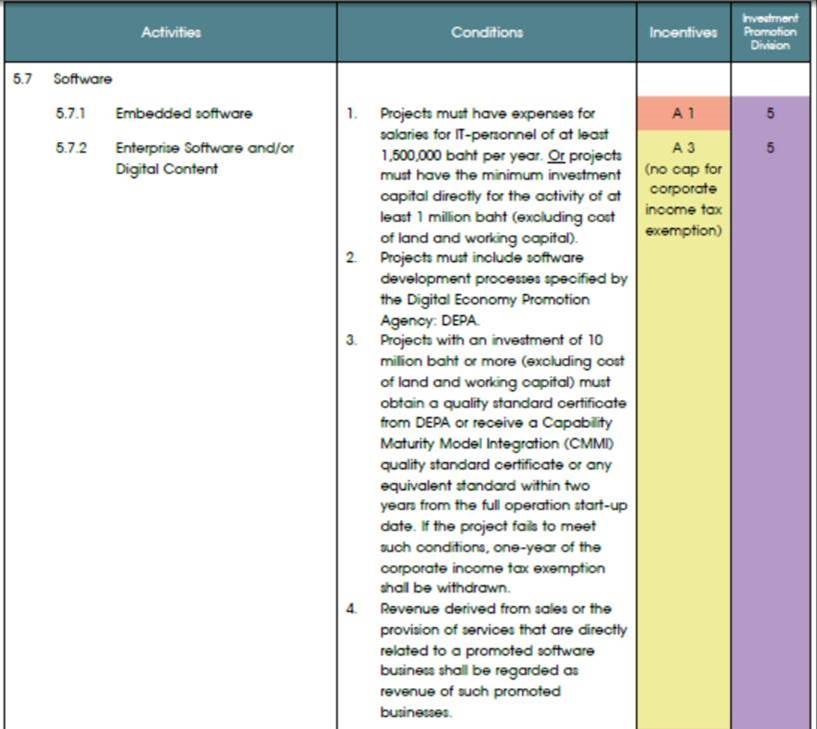

Regarding your business that describe in your e-mail, online platform is eligible for investment promotion under the activity 5.9 Digital Services which are software platform, managed service, digital architecture design service, and digital services such as FinTech, DigiTech, MedTech, AgriTech, etc.

Conditions:

- Projects must hire digital specialists and have capital investment (excluding cost of land and working capital) not less than 1,000,000 baht.

- Projects must include digital service processes as approved by the Board.

- Projects with an investment of 10 million baht or more (excluding cost of land and working capital) must be certified with ISO 20000 or other quality standard certificate as approved by the Ministry of Information and Communication Technology within 2 years from the full operation start-up date, otherwise the corporate income tax exemption shall be reduced by 1 year.

- Revenue derived from sales or the provision of services that are directly related to a promoted digital service business shall be regarded as revenue of such promoted businesses.

- Projects must gain approval from Ministry of Digital Economy and Society before applying for investment promotion.

Incentives: Category A3 include Tax and Non-tax incentives as follows:

Tax incentives:

1) 5-year corporate income tax exemption (limited for 100% of investment excluding the cost of land and working capital).

2) Exemption of import duty for machinery.

3) Exemption of import duty on raw or essential materials imported for use in production for export

Non-Tax incentives:

1) Permit for foreign nationals to enter the Kingdom for the purpose of studying investment opportunities.

2) Permit to bring into the Kingdom skilled workers and experts to work in promoted activities.

3) Permit to own land to implement for BOI's project.

4) Permit to take out or remit money abroad in foreign currency

Criteria for project approval:

1) Investment in new machineries or related equipment.

2) For newly established project, the dept-to-equity ratio must not exceed 3 to 1.

For further information, please find from attached:

1) Application for Investment Promotion for Digital Business (F PA PP 04-08) (EN) Therefore, you can apply via online at E-Investment from this link:

https://boi-investment.boi.go.th/public/index_en.php

2) For more information about projects that we promoted; you can find from A Guide to The Board of Investment 2019.

BOI is a government agency responsible for promoted business through tax and non-tax incentives such as Tax-Holiday or Visa/Work permit facilitation. We currently promote more than 330 types of business from manufacturing to services. The benefits ranges from corporate income tax up to 13 years, exemption of import duty for machineries etc. To introduce you to our promotion scheme, I have attached our comprehensive guidebook with this email.

Regarding the software development or digital service, you might be able to apply for our 5.7 Software Development or 5.9 Digital Services.

|

|

If promoted by these category you will receive incentive package A1 or A3 which you will get these following benefits:

|

Regarding your questions about Foreign Business Act, we are afraid that we are not an authority in charge of this law, and, therefore, cannot make judgement for you. However, there’s a clause in foreign business act as follows:

|

Therefore:

- For classification, please contact Department of Business Development, Ministry of Commerce. https://www.dbd.go.th/dbdweb_en/more_news.php?cid=246

- If you’re interested in getting BOI, please consider our category 5.9 Digital Service. The conditions are as described in the details mentioned above. For more information, please refer to the Guide attached. If you wish to apply, please check out our online platform: https://boi-investment.boi.go.th/public/