1. The scope of raw and essential materials eligible for import duty exemption

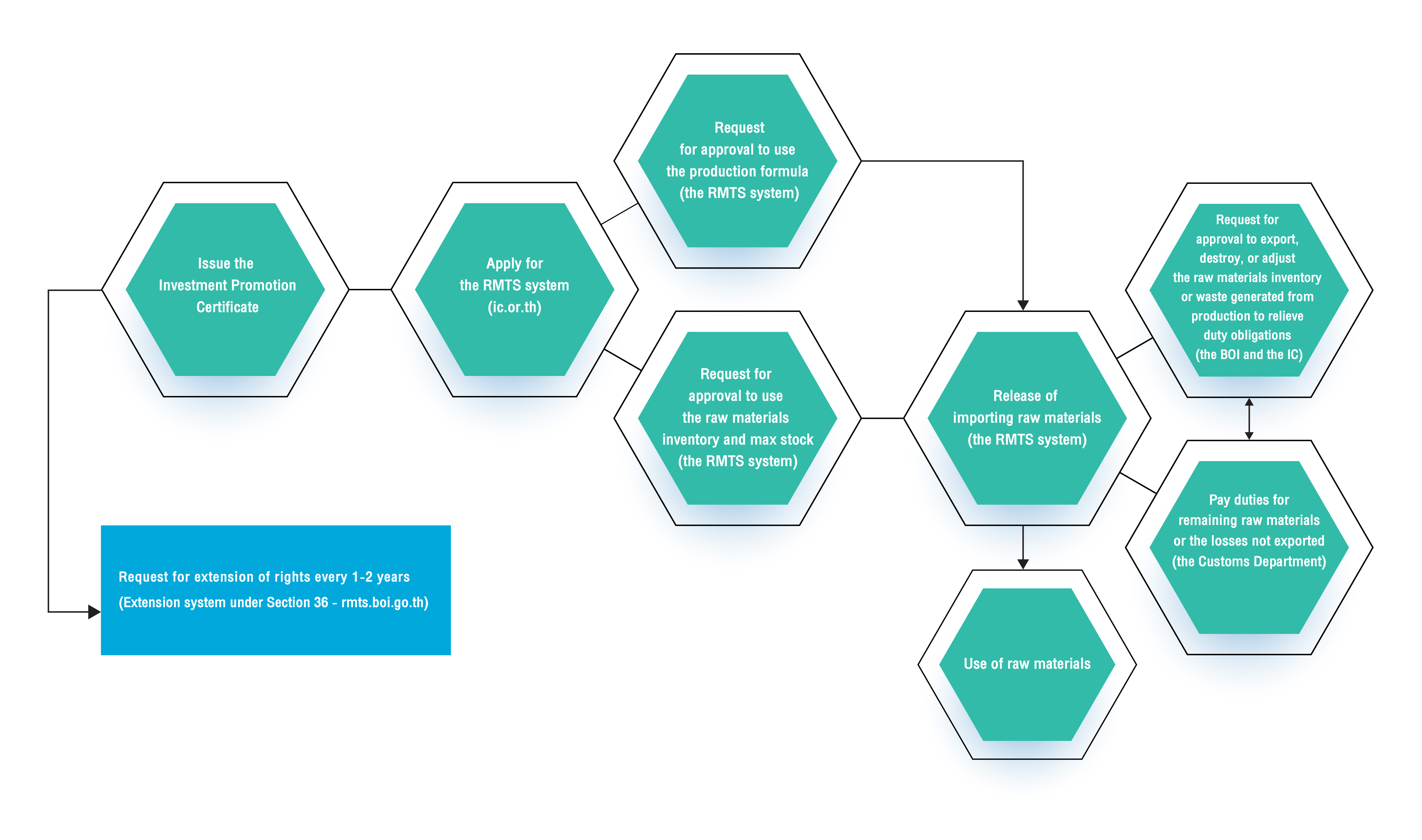

2. Overview of import duty exemption for raw materials used in export products (Section 36)

3. Extension of import duty exemption period for raw materials under Section 36

4. Production formula

5. Maximum stock

6. Raw material inventory account

Primary Name |

Secondary Name |

Description |

Powder detergent |

Breeze |

Powder detergent is used for washing clothes. |

Omo |

Powder detergent is used for washing clothes. |

|

Remote control |

Remote |

Remote control |

TV Remote |

TV Remote control |

|

Remote TV |

Remote control TV |

Primary Name |

Secondary Name |

Description |

Max Stock Quantity |

Powder Detergent |

Breeze |

Powder detergent is used for washing clothes. |

10,000 |

Omo |

Powder detergent is used for washing clothes. |

||

Remote control |

Remote |

Remote control |

10,000 |

TV Remote |

TV remote control |

||

|

Remote TV |

Remote control TV |

The release of raw materials can be categorized as follows:

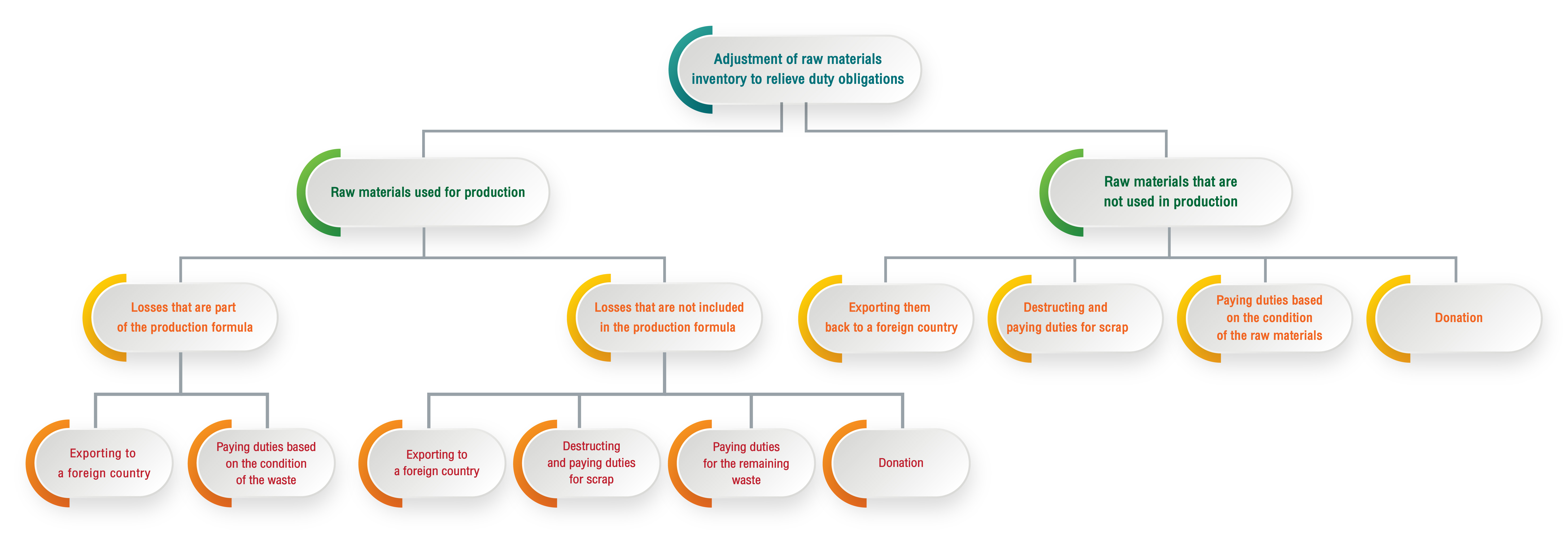

8. Adjustment of raw materials inventory

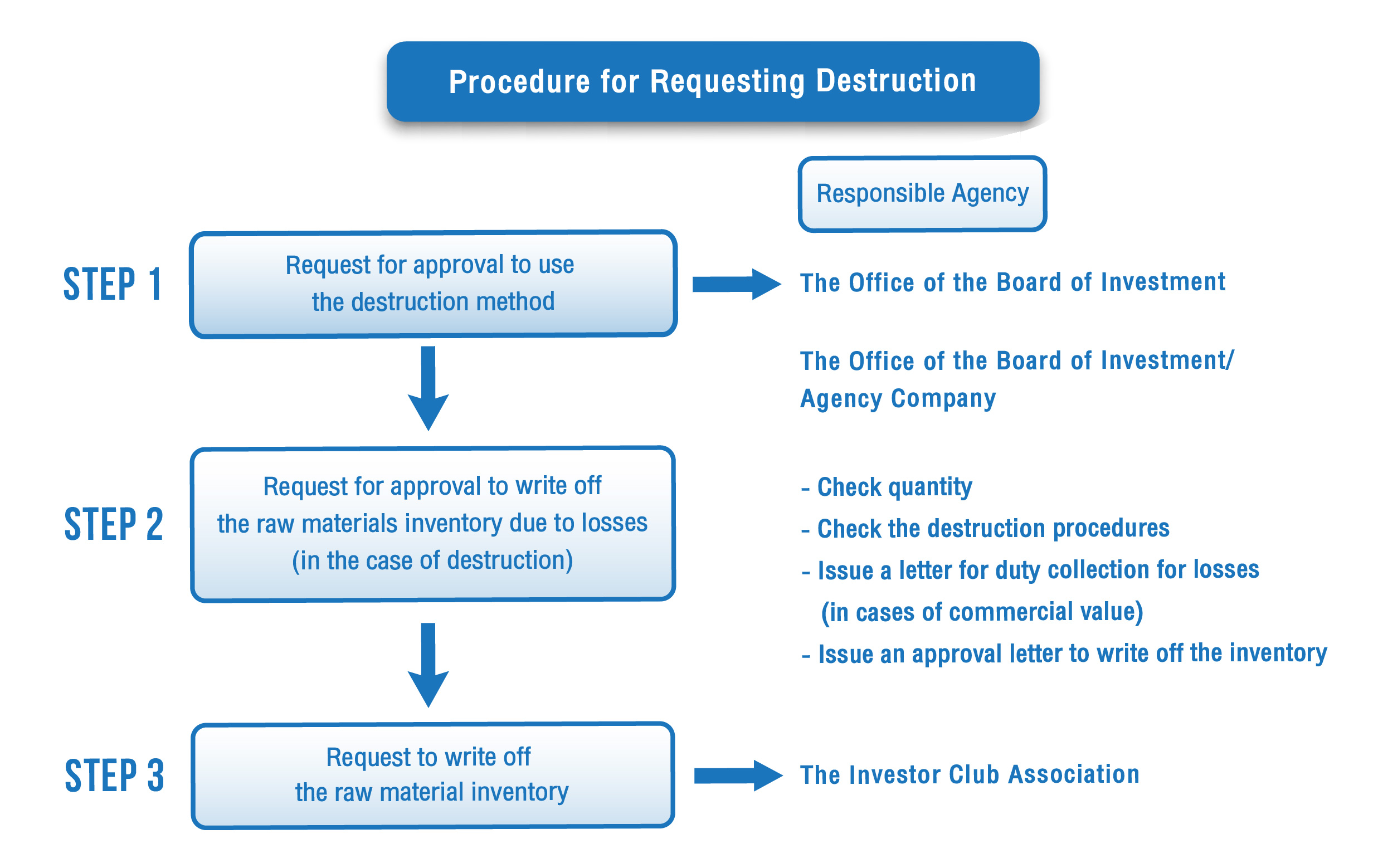

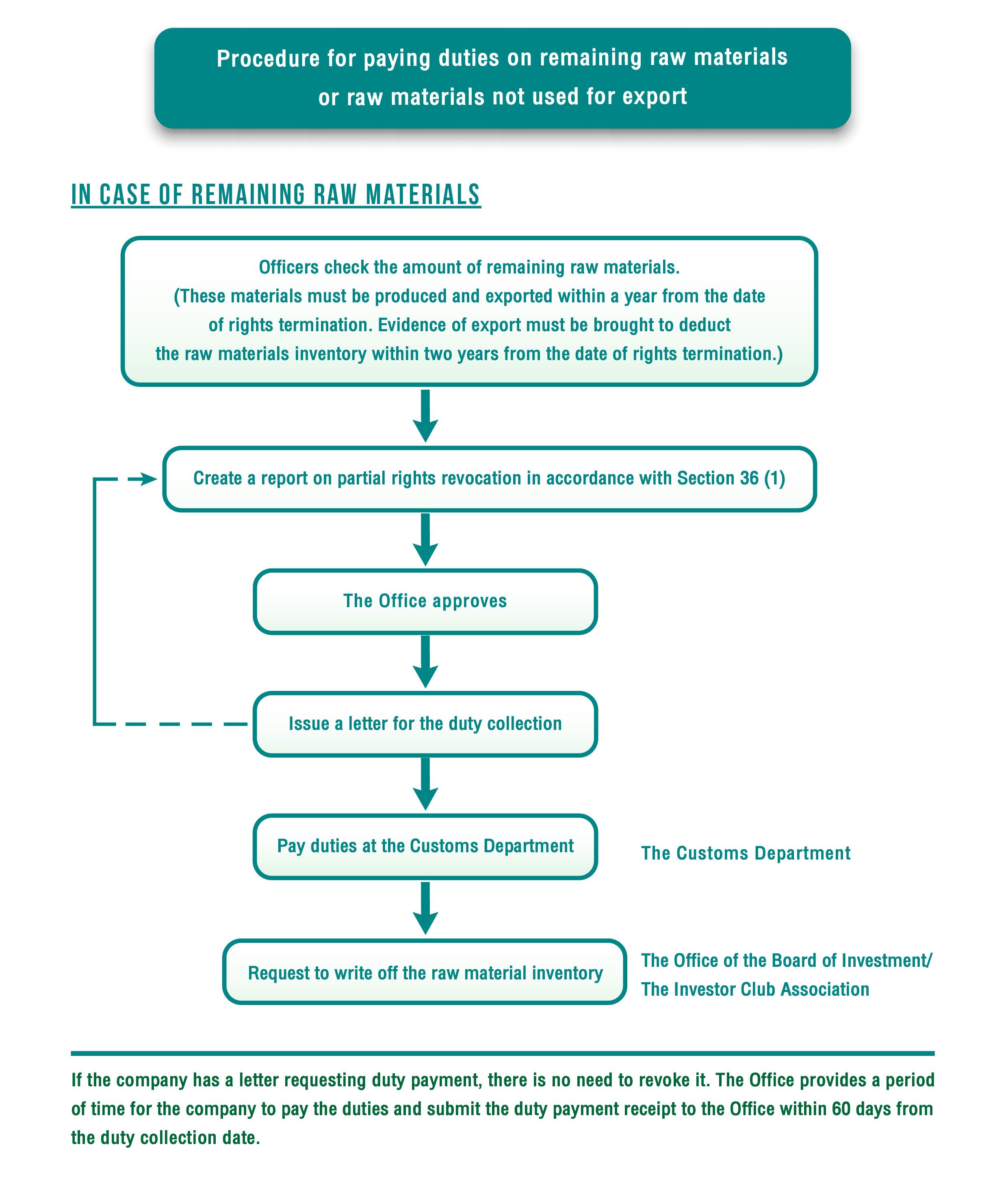

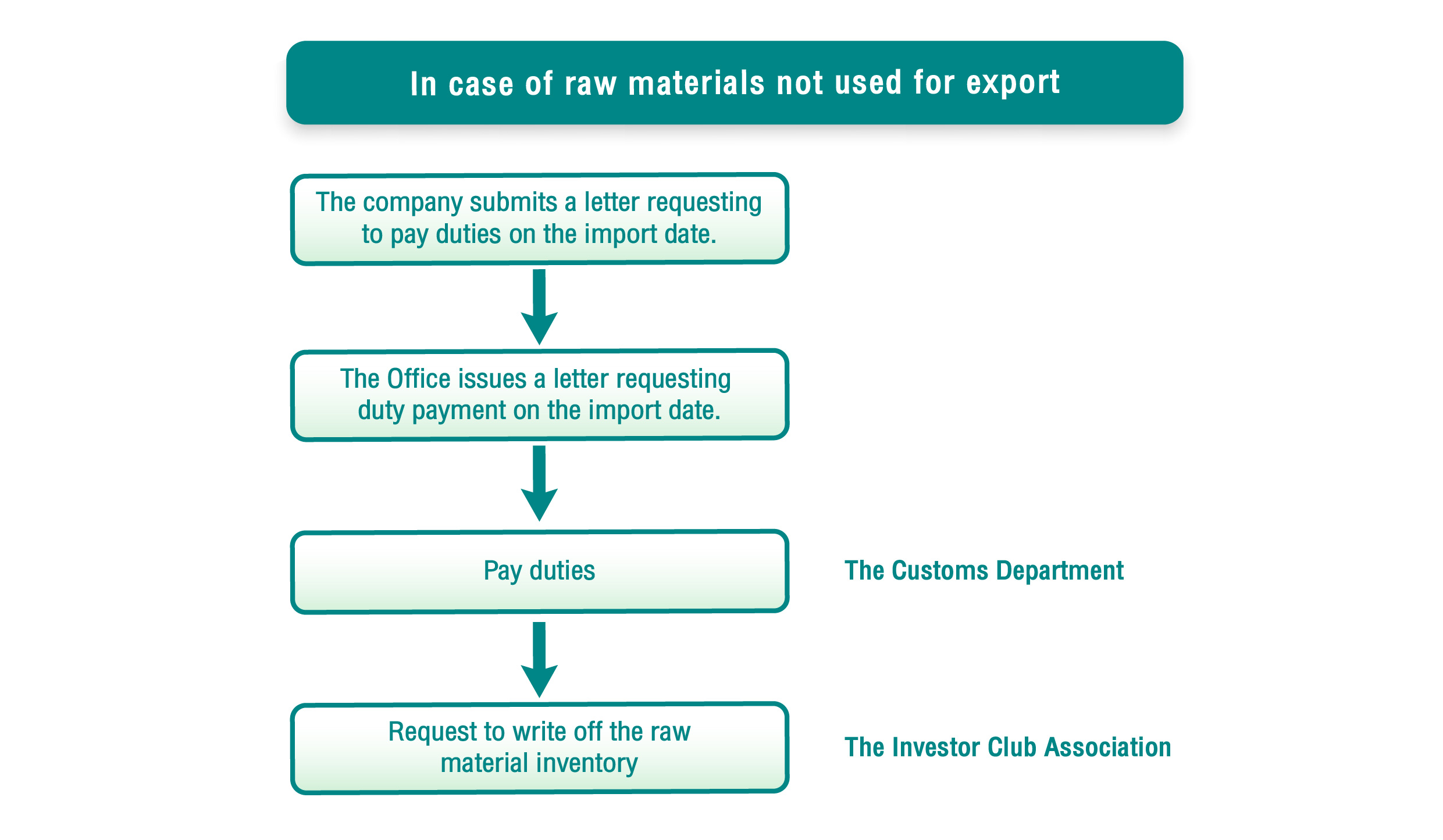

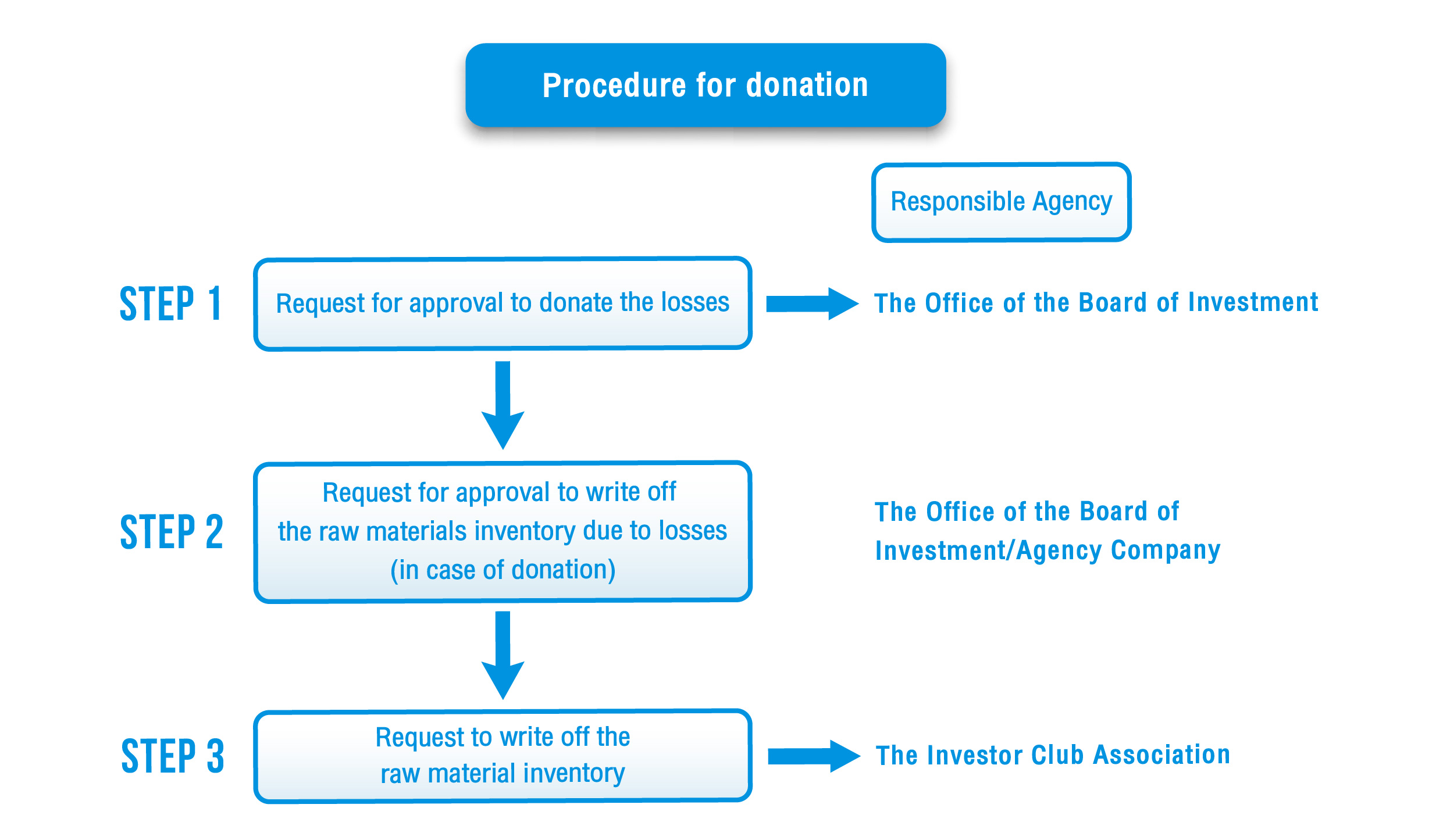

Actions related to waste must be approved before proceeding.

| Request |

Processing Time |

Required Documents and Evidence for Consideration |

|---|---|---|

1. Approval for the stock quantity inventory |

30 business days |

Apply for approval to manage the stock quantity inventory through the RMTS Online System as per the details provided in the system |

2. Request for approval to release raw materials |

3 hours |

Submit through the paperless system |

3. Request for approval to use the production formula |

30 business days |

Apply for approval to use the production formula through the RMTS Online System as per the details provided in the system |

4. Request for approval to write off the raw materials inventory |

3 business days |

For export declaration forms from October 1, 2020, any request for write-off the inventory must be submitted through the RMTS2011 system only, by filling in the information according to the file format specified by the system. |

5. Request for approval to use an import duty guarantee for raw materials and essential materials 5.1 In case an investment promotion certificate has not been issued yet. |

3 hours |

Submit through the RMTS2011 system |

5.2 In case an investment promotion certificate has already been issued. |

3 hours |

Submit through the RMTS2011 system |

6. Extension of an import duty guarantee period |

1 business day |

Submit the request via the Investor Club Association |

7. Release and withdrawal of raw materials guarantee 7.1 Section 30 |

3 hours |

Submit the request via the Investor Club Association |

7.2 Section 36 |

3 hours |

Submit the request via the Investor Club Association |

8. Extension of raw materials import period 8.1 Extension of raw materials import period in accordance with Section 30 |

30 business days |

- The applicant submits the request for approval to extend the raw materials import period in accordance with Section 30. - Request form for the extension of the raw materials import period in accordance with Section 30 (F IN ER 02), to be filled out with company-specific information only - Report form for imported raw materials or essential materials in the past year (F IN ER 03) - Summary form for the quantity of used raw materials or essential materials (F IN ER 04) - List form for raw materials or essential materials expected to be imported in the next year (F IN ER 05) - A copy of the first investment promotion certificate - A copy of the last investment promotion certificate in accordance with Section 30 |

8.2 Extension of raw materials import period in accordance with Section 36 |

30 business days |

Submit a request for an extension of raw materials import period through the electronic system |

Source: Utilization of Promotional Privileges (Page 242)

All actions must be approved before proceeding.

- RMTS Online form

- Raw Material Approval Form to be submitted for approval by the BOI

- Guide for Submitting Raw Material Inventory and Production Formula + Adjusting Raw Material Balances (RMTS Online System)

- Guide for Submitting Raw Material Release Requests (RMTS Online System)

- Guide for Submitting Raw Material Adjustments Requests (RMTS Online System)