Corporate Income Tax

Corporate Income Tax

Corporate Income Tax (CIT) is a direct tax levied on a juristic company or partnership carrying on business in Thailand or not carrying on business in Thailand but deriving certain types of income from Thailand.

1. Taxable Persons

1.1 A company or a juristic partnership incorporated under Thai law.

(1) Limited company

(2) public company limited

(3) limited partnership

(4) registered partnership

1.2 A company or a juristic partnership incorporated under foreign law

1.2.1 A company or juristic partnership incorporated under foreign laws and carrying on business in Thailand.

1.2.2 A company or juristic partnership incorporated under foreign laws and carrying on business in other places including Thailand.

1.2.3 A company or juristic partnership incorporated under foreign laws and carrying on business in other places including Thailand , in case of carriage of goods or carriage of passengers

1.2.4 A company or juristic partnership incorporated under foreign laws which has an employee, an agent or a go-between for carrying on business in Thailand and as a result receives income or profits in Thailand.

1.2.5 A company or juristic partnership incorporated under foreign laws and not carrying on business in Thailand but receiving assessable income under Section 40 (2)(3)(4)(5) or (6) which is paid from or in Thailand.

1.3 A business operating in a commercial or profitable manner by a foreign government, organization of a foreign government or any other juristic person established under a foreign law.

1.4 Joint venture

1.5 A foundation or association carrying on revenue generating business, but does not include the foundation or association as prescribed by the Minister in accordance with Section 47 (7) (b) under Revenue Code

(Source: http://www.rd.go.th/publish/6044.0.html) Last updated: November 6, 2015

2. File a Tax Return and Payment

Thai and foreign companies carrying on business in Thailand are required to file their tax returns (Form CIT 50) within one hundred and fifty (150) days from the closing date of their accounting periods. Tax payment must be submitted together with the tax returns. Any company disposing funds representing profits out of Thailand is also required to pay tax on the sum so disposed within seven days from the disposal date (Form CIT 54).

In addition to the annual tax payment, any company subject to CIT on net profits is also required to make tax prepayment (Form CIT 51). A company is obliged to estimate its annual net profit as well as its tax liability and pay half of the estimated tax amount within two months after the end of the first six months of its accounting period. The prepaid tax is creditable against its annual tax liability.

As regards to income paid to foreign company not carrying on business in Thailand, the foreign company is subject to tax at a flat rate in which the payer shall withhold tax at source at the time of payment. The payer must file the return (Form CIT 54) and make the payment to the Revenue Department within seven days of the following month in which the payment is made.

(Source: http://www.rd.go.th/publish/6044.0.html) Last updated: November 6, 2015

3. Accounting Period

An accounting period shall be twelve months except in the following cases where it may be less than twelve months:

1. a newly incorporated company or juristic partnership may elect to use the period from its incorporation date to any one date as the first accounting period.

2. a company or juristic partnership may file a request to the Director-General to change the last day of an accounting period. In such a case, the Director-General shall have the power to grant approval as he deems appropriate. Such an order shall be notified to the company or juristic partnership who files the request within a reasonable period of time and in the case where the Director-General grants the permission, the company or juristic partnership shall comply to the accounting period as prescribed by the Director-General.

(Source: http://www.rd.go.th/publish/6044.0.html) Last updated: November 6, 2015

4. Tax Calculation

In the calculation of CIT of a company carrying on business in Thailand, it is calculated from the company's net profit on the accrual basis. A company shall take into account all revenue arising from or in consequence of the business carried on in an accounting period and deducting therefrom all expenses in accordance with the condition prescribed by the Revenue Code. As for dividend income, one-half of the dividends received by Thai companies from any other Thai companies may be excluded from the taxable income. However, the full amount may be excluded from taxable income if the recipient is a company listed in the Stock Exchange of Thailand or the recipient owns at least 25% of the distributing company's capital interest, provided that the distributing company does not own a direct or indirect capital interest in the recipient company. The exclusion of dividends is applied only if the shares are acquired not less than 3 months before receiving the dividends and are not disposed of within 3 months after receiving the dividends.

In calculating CIT, deductible expenses are as follows:

1. Ordinary and necessary expenses. However, the deductible amount of the following expenses is allowed at a special rate:

- 200% deduction of Research and Development expense,

- 200% deduction of job training expense,

- 200% deduction of expenditure on the provision of equipment for the disabled;

2. Interest, except interest on capital reserves or funds of the company;

3. Taxes, except for Corporate Income Tax and Value Added Tax paid to the Thai government;

4. Net losses carried forward from the last five accounting periods;

5. Bad debts;

6. Wear and tear;

7. Donations of up to 2% of net profits;

8. Provident fund contributions;

9. Entertainment expenses up to 0.3% of gross receipt but not exceeding 10 million baht;

10. Further tax deduction for donations made to public education institutions, and also for any expenses used for the maintenance of public parks, public playgrounds, and/or sports grounds;

11. Depreciation: Provided that in no case shall the deduction exceed the following percentage of cost as shown below. However, if a company adopts an accounting method, which the depreciation rates vary from year to year, the company is allowed to do so provided that the number of years over which an asset depreciated shall not be less than 100 divided by the percentage prescribed below.

|

Types of Assets |

Depreciation Rates |

|

1. Building 1.1. Durable building 1.2. Temporary building |

5%

100% |

|

2. Cost of acquisition of depleted natural resources |

5% |

|

3. Cost of acquisition of lease rights 3.1. no written lease agreement 3.2. written lease agreement containing no renewal clause or containing renewal clause but with a definite duration of renewal periods |

10% 100% divided by the original and renewable lease periods |

|

4. Cost of acquisition of the right in a process, formula, goodwill, trademark, business license, patent, copyright or any other rights: 4.1. unlimited period of use 4.2. limited period of use |

10% 100% divided by the original and renewable lease periods |

|

5. Other depreciation except land and goods 5.1. machinery used in R&D 5.2. cash registering machine 5.3. passenger car or bus with no more than 10 passengers capacity |

20% - initial allowance of 40% on the date of acquisition and the residual can be depreciated at the rate in 5 - initial allowance of 40% on the date of acquisition and the residual can be depreciated at the rate in 5 - depreciated at the rate in 5 but the depreciable valve is limited to one million baht |

|

6. Computer and accessories 6.1. SMEs* 6.2. other business |

- initial allowance of 40% on the date of acquisition and the residual can be depreciated over 3 years - depreciated over 3 years |

|

7. Computer programs 7.1. SMEs* 7.2. other business |

- initial allowance of 40% on the date of acquisition and the residual can be depreciated over 3 years - depreciated over 3 years |

* SMEs refer to any Thai companies with fixed assets less than 200 million baht and number of employee not exceeding 200 people

12. The following items shall not be allowed as expenses in the calculation of net profits:

1) Reserves (with some exceptions):

2) Fund except provident fund under the rules, procedures and conditions prescribed by a Ministerial regulations.

3) Expense for personal, gift, or charitable purpose except expense for public charity, or for public benefit

4) Entertainment or service fees

5) Capital expense or expense for the addition, change, expansion or improvement of an asset but not for repair in order to maintain its present condition.

6) Fine and/or surcharge, criminal fine, income tax of a company or juristic partnership.

7) The withdrawal of money without remuneration of a partner in a juristic partnership

8) The part of salary of a shareholder or partner which is paid in excess of appropriate amount.

9) Expense which is not actually incurred or expense which should have been paid in another accounting period except in the case where it cannot be entered in any accounting period, then it may be entered in the following accounting period.

10) Remuneration for assets which a company or juristic partnership owns and uses.

11) Interest paid to equity, reserves or funds of the company or juristic partnership itself.

12) Damages claimable from an insurance or other protection contracts or loss from previous accounting periods except net loss carried forward for five years up to the present accounting period.

13) Expense which is not for the purpose of making profits or for the business.

14) Expense which is not for the purpose of business in Thailand.

15) Cost of purchase of asset and expense related to the purchase or sale of asset, but only the amount in excess of normal cost and expense without reasonable cause.

16) Value of lost or depleted natural resources due to the carrying on of business.

17) Value of assets apart from devalued assets subject to Section 65 Bis.

18) Expense which a payer cannot identify the recipient.

19) Any expense payable from profits received after the end of an accounting period.

20) Expense similar to those specified in (1) to (19) as will be prescribed by a Royal Decree.

(Source: http://www.rd.go.th/publish/6044.0.html) Last updated: November 6, 2015

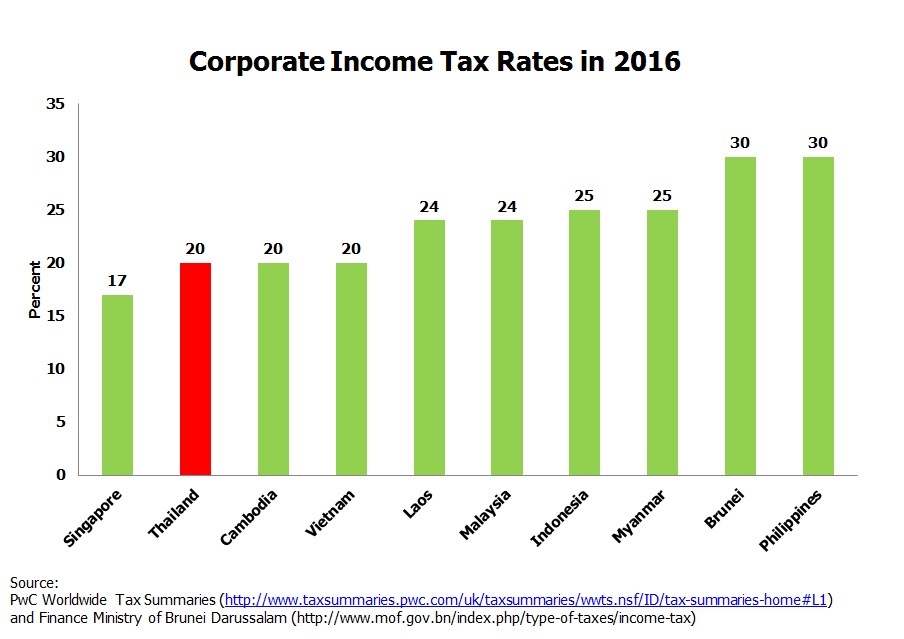

5. Tax Rates

The corporate income tax rate in Thailand is 20% on net profit for the accounting periods 2015. However, the rates vary depending on types of taxpayers.

|

Taxpayer |

Tax Base |

Rate (%) |

|

1. Small company1 |

Net profit not exceeding 300,000 baht Net profit from 300,000 not exceeding 3 million baht Net profit over 3 million baht |

Exempt 15%

20% |

|

2. Companies listed in Stock Exchange of Thailand (SET) |

Net profit |

20% |

|

3. Companies newly listed in Stock Exchange of Thailand (SET) |

Net Profit |

20% |

|

4. Company newly listed in Market for Alternative Investment (MAI) |

Net Profit for the amount not exceeding 50 million baht

|

20% |

|

5. Bank deriving profits from International Banking Facilities (IBF) |

Net Profit |

10% |

|

6. Foreign company engaging in international transportation |

Gross receipts |

3% |

|

7. Foreign company not carrying on business in Thailand receiving dividends from Thailand |

Gross receipts |

10% |

|

8. Foreign company not carrying on business in Thailand receiving other types of income apart from dividend from Thailand |

Gross receipts |

15% |

|

9. Foreign company disposing profit out of Thailand. |

Amount disposed |

10% |

|

10. Profitable association and foundation. |

Gross receipts |

2% or 10% |

Notes: 1 A small company refers to any company with paid-up capital less than 5 million baht at the end of each accounting period.

Source: http://www.rd.go.th/publish/6044.0.html

Last Updated: July 2016

|

6. Withholding Tax

Certain types of income paid to companies are subject to withholding tax at source. The withholding tax rates depend on the types of income and the tax status of the recipient. The payer of income is required to file the return (Form CIT 53) and submit the amount of tax withheld to the District Revenue Offices within seven days of the following month in which the payment is made. The tax withheld will be credited against final tax liability of the taxpayer. The following are the withholding tax rates on some important types of income.

|

Types of income |

Withholding tax rate |

|

1. Dividends |

10% |

|

2. Interest1 |

1% |

|

3. Royalties2 |

3% |

|

4. Advertising Fees |

2% |

|

5. Service and professional fees |

3% if paid to Thai company or foreign company having permanent branch in Thailand;

5% if paid to foreign company not having permanent branch in Thailand |

|

6. Prizes |

5% |

Notes:

1. Tax will be withheld on interest paid to associations or foundations at the rate of 10%.

2. Royalties paid to associations or foundations are subject to 10% withholding tax rate.

3. Government agencies are required to withhold tax at the rate of 1% on all types of income paid to companies.

(Source: http://www.rd.go.th/publish/6044.0.html) Last updated: November 6, 2015

7. Losses

Each company is taxed as a separate legal entity. Losses incurred by one affiliate may not be offset against profits made by another affiliate. Losses can only be carried forward for a maximum of five years.

Source: Doing Business in Thailand 2015-2016, Mazars

8. Tax Credits

For income derived from countries that do not have a Double Taxation Agreement (DTA) with Thailand, foreign tax credits are allowed. These foreign tax credits are subject to certain criteria and conditions, up to the amount of Thailand tax that would have been payable had the income been derived in Thailand. The same rules apply with regard to foreign tax relief for DTA countries.

Source: Doing Business in Thailand 2015-2016, Mazars

9. Tax Treaties to Avoid Double Taxation (http://www.rd.go.th/publish/766.0.html)

Currently, Thailand has concluded tax treaty agreements with 60 countries: Armenia, Australia, Austria, Bahrain, Bangladesh, Belarus, Belgium, Bulgaria, Canada, Chile, China P.R., Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Great Britain and Northern Ireland, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Korea, Kuwait, Laos, Luxembourg, Malaysia, Mauritius, Myanmar, Nepal, the Netherlands, New Zealand, Norway, Oman, Pakistan, the Philippines, Poland, Romania, Russia, Seychelles, Singapore, Slovenia, South Africa, Spain, Srilanka, Sweden, Switzerland, Taiwan (Chinese Taipei), Tajikistan, Turkey, Ukraine, United Arab Emirates, United States of America, Uzbekistan, Vietnam

Last update: August 6, 2015

10. Transfer Pricing Rules

In addition to paying dividends, profits may be repatriated through other various means, including payment of royalties and/or service fees.

Although there is no separate transfer pricing legislation in Thailand, guidelines have been issued to counteract aggressive inter-company pricing practices and to ensure such payments reflect the true market value. These guidelines are intended to prevent the manipulation of profits and losses within a group of related companies and ensure that goods and services traded between the related companies are priced at an arm’s length value. The Revenue Department also has the power to assess income resulting from transfers which it deems below market value.

Source: Doing Business in Thailand 2015-16, Mazars

Page Updated: August 2017