Investment Promotion Measures for Community and Society Development

In order to encourage business operators to be involved in local community and society development by collaborating with local organizations to enhance competitiveness, to improve the quality of life of the people at the grassroots level to be strong and able to be self-reliant, and to reduce the PM 2.5 dust issues sustainably through improved forest management and environment, the Board of Investment announces the followings.

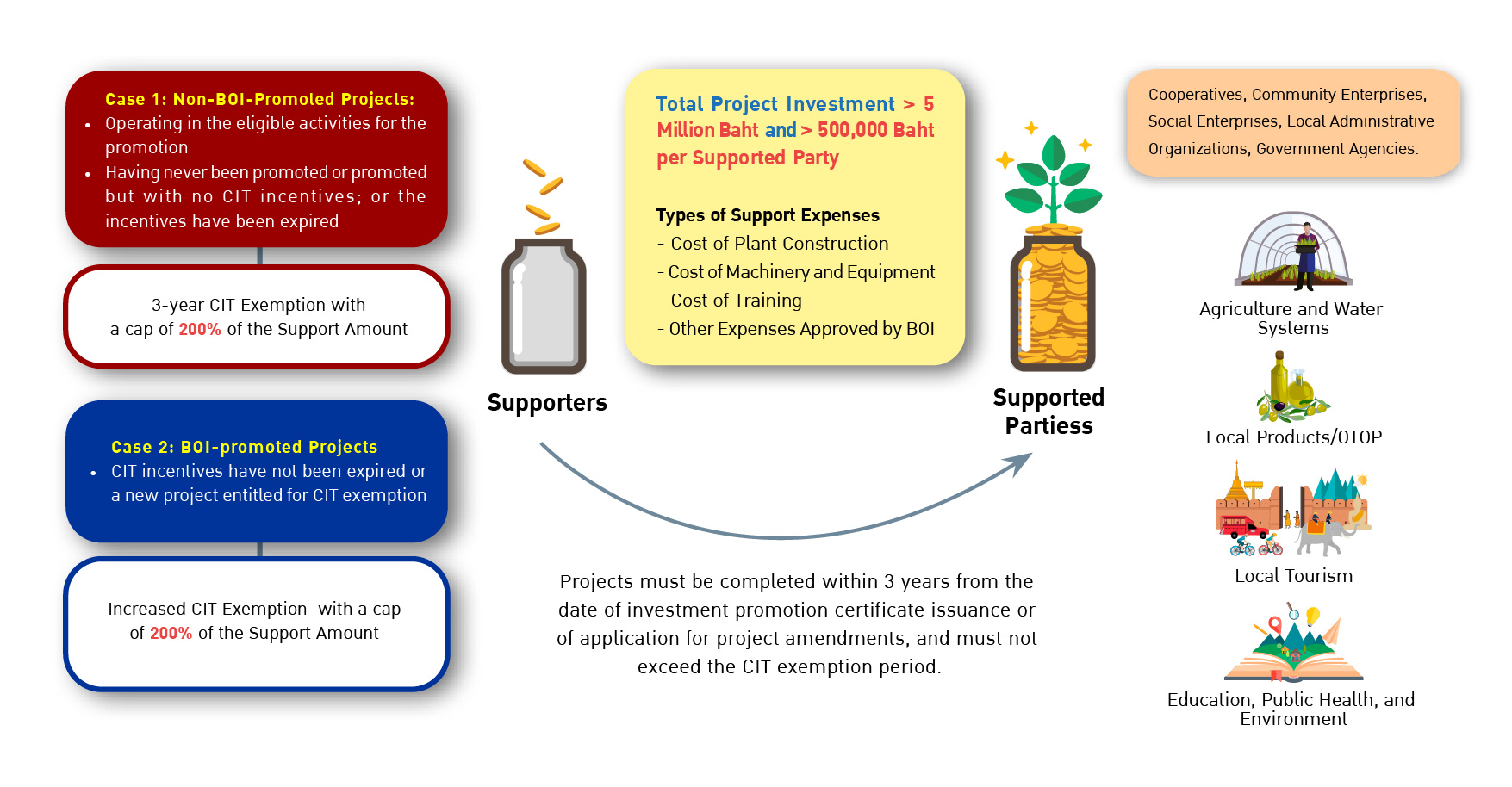

1. This measure applies to projects that are currently in operation, regardless of whether they received BOI-promotion or not. This measure also applies to new investment projects which are about to receive BOI rights and benefits to be exempt from corporate income tax. The investment activities must be eligible for investment promotion by the Board of Investment by the time of submitting the application under this measure.

2. The projects supporting the local community and society must have a minimum investment capital of 5,000,000 Baht (excluding the cost of land and working capital) and must support local organizations at a minimum of 500,000 Baht per entity.

3. A supported local organization means a local cooperative, a community enterprise, a social enterprise or a local farmers group registered with the relevant authority or local government organization, a public educational institution or a government healthcare institution which is operating at least one activity in the prescribed scope, namely agricultural activities, holistic water resource management, local community products, community tourism, environmental enhancement activities, educational activities, public health activities, and also include supporting of local communities which collaborate with government-owned research institution or public educational institution.

4. The projects must present a collaboration plan with local organizations to support competitiveness enhancement in production and services, to support local organizations in holistic water resources management, in sustainable agricultural business development, in upgrading the environment, education or public health aspect. The plan should show the benefits that the community and society will gain. In the following cases, approval from relevant agencies must be obtained:

(1) In the case of supporting holistic water resource management, the operation must be implemented only in repetitiously drought-stricken or flooded areas. The water management plan must be approved by the Office of the National Water Resources and must comply with the country’s water resource management plans.

(2) In the case of supporting the development of sustainable agriculture, the action plan must be approved by relevant agencies, such as the National Bureau of Agricultural Commodity and Food Standards.

(3) In the case of supporting the environmental improvement through forest management and the sustainable PM 2.5 dust reduction, the action plan must be approved by the Ministry of Natural Resources and Environment

5. The investments to support local organizations shall be determined by the BOI as follows:

- In the case of supporting competitiveness enhancement in production or services: relevant expenses shall include costs of factory construction, machinery and equipment and training, etc.

- In the case of supporting holistic water resource management: relevant expenses shall include costs of supporting digging wells to store water, costs of construction and repair of dams, costs of drilling, repair and maintenance/cleaning of groundwater wells, etc.

- In the case of supporting the development of sustainable agriculture: relevant expenses shall include such as costs of machinery and equipment; costs of training on modern agricultural technology to reduce greenhouse gas emissions, and production optimization technology for sustainable development; costs related to using technology in land management, such as surface soil adjustment, management of straw and stubble, harvesting, soil and water analysis, and uses of chemicals in the production process correctly and safely; costs of rice quality inspection and certification, costs of monitoring and assessing the performance of greenhouse gas emission, etc.

- In the case of supporting environmental enhancement: relevant expenses shall include cost of waste sorting tools or equipment in the community, etc.

- In the case of forest management to reduce PM 2.5 dust: relevant expenses shall include such as costs of construction of wet forest fire protection barrier, costs of construction of a moisture retention dam, costs of forest fire extinguishing tools and equipment, costs of training in forest fire prevention and control, etc.

- In the case of supporting public health: relevant expenses shall include costs of medical tools and equipment, costs of construction or renovation of exam rooms or patient rooms, etc.

- In the case of supporting government educational institutions: relevant expenses shall include costs of construction or renovation of classrooms, laboratories, or supporting tools and equipment for educational institutions, etc.

However, the relevant expenses must not be an expense used to claim rights and benefits from other government agencies.

6. Incentives

6.1 In the case of existing BOI promoted projects where corporate income tax exemption or reduction has expired or BOI promoted projects that were not eligible for corporate income tax incentives or non-BOI promoted projects, following incentives shall be granted:

(1) The promoted projects are to receive corporate income tax exemption for 3 years, in an amount not exceeding 200 percent of the investment capital excluding the cost of land and working capital. The corporate income tax exemption shall be for the income from existing activities. The corporate income tax exemption limit will be calculated on the actual investment expenses excluding the cost of land and working capital paid to support local organizations as determined by the Office of the Board of Investment.

(2) The corporate income tax exemption shall begin after the date of the first income after receiving the investment promotion certificate. The project implementation must be completed within 3 years from the date of investment promotion certificate issuance.

(3) Other non-tax incentives

6.2 Existing BOI-promoted projects where corporate income tax exemption incentives have not expired, or new investment projects applying for investment promotion entitled to corporate income tax exemption benefits:

(1) The promoted projects are to receive corporate income tax exemption in an amount not exceeding 200 percent of the investment capital excluding the cost of land and working capital. The corporate income tax exemption limit will be calculated on the actual investment expenses excluding the cost of land and working capital paid to support local organizations as determined by the Office of the Board of Investment.

(2) The project implementation must be completed within 3 years from the date of investment promotion certificate issuance or the date of approval for the project amendment, as the case may be. The timing for project implementation must not exceed the period of corporate income tax exemption.

Read More :

Announcement of the Board of Investment No. 1/2567 : Investment Promotion Measures for Community and Society Development

ขออภัยครับ ไม่มีข้อมูลส่วนนี้ ในภาษาที่ท่านเลือก !

Sorry, There is no information support your selected language !

Download และ ติดตั้งโปรแกรมอ่าน PDF

Download PDF Readerขออภัยครับ ไม่มีข้อมูลส่วนนี้ ในภาษาที่ท่านเลือก !

Sorry, There is no information support your selected language !

Download และ ติดตั้งโปรแกรมอ่าน PDF

Download PDF ReaderSite map